A key component of growing your law firm and hitting your personal and professional goals as a lawyer is financial planning.

Financial planning is a major part of any law firm’s business plan. Having a plan gives you the best chance of keeping your firm’s doors open. It also allows you to plan for important activities that will help you scale.

By implementing proper budgeting, investment strategies, and tax optimization, you can achieve long-term success and financial stability.

The Importance of Financial Planning for Lawyers

It takes a lot of work and risk to set up and run a successful law firm. Taking on that risk is worth it for the potential return, but it starts with a sound financial plan.

Lawyers have great earning potential but often struggle to set aside money early in their careers. This can force lawyers to work longer than they’d like before hitting retirement. If you’re investing your cash into managing your own law firm, these issues may be amplified.

Lawyers also face high rates of burnout and potential malpractice lawsuits. Both of these factors can hamper their ability to earn and grow their assets.

Proper financial planning can help minimize these problems.

Only one-third of Americans have a financial plan for themselves. Of those who have a financial plan, 65% say they feel stable compared with their peers.

To get to that stability, you need financial planning. Having a plan ensures financial security and can help you meet your personal and professional goals.

Beyond individual strategies, many lawyers must also consider the finances of their business. Lawyers need a financial plan to handle things like overhead, operating expenses, business debt, and taxes.

At the business level, lawyers may want to consider ideas like:

- Creating cash reserves to help with cash flow issues

- Exploring temporary lines of credit to pull from in case of emergency

- Forecasting large expenses ahead of time

- Making plans for partner distributions or reinvestment into the firm

- Planning for ROI-positive spending, such as developing a law firm marketing budget

Creating a comprehensive financial plan for your law firm requires you to consider a number of factors. Budgeting, saving, taxes, and how you manage your debt are the biggest components. In many cases, seeking the help of a financial expert is the best choice for lawyers who want to build a thriving practice.

Budgeting and Expense Management

Budgeting is a fundamental part of business plans for lawyers and law firms. Planning ahead for your spending and tracking actual costs is vital for keeping your law firm in the black.

A comprehensive budget helps you plan for the fixed and variable costs of operations. With it, you can plan for things like office rent, utilities, insurance, and staffing.

But creating a budget and tracking expenses won’t just keep your firm at a subsistence level. You’ll also be able to identify areas for cost reduction and find room to invest in the things that can help your firm grow.

For example, you may see time and money lost on unproductive labor during the client intake process. You may also see a decline in billable hours due to productivity losses. You could look in your budget and see if their room to buy client intake software to help make your staff more productive in this step.

Or you may want to increase the number of new clients coming to your firm. To do so, you can look at your budget to determine how much room you have for law firm marketing.

Making room in your budget for investments that drive progress forward can lead to long-term law firm profitability. Over time, these investments should reduce costs and grow revenue.

Of course, budgeting not only helps with expense planning and revenue generation, but it also shows you where you can earmark cash for savings.

Savings and Investment Strategies

Establishing savings and investment strategies tailored for lawyers is crucial for building wealth and achieving financial goals. You can get started with some basics and grow your plans over time.

Individuals lawyers can start by:

- Setting up an emergency fund

- Diversifying investments, including retirement plans and accounts

- Seeking professional advice for customized investment plans

- Reevaluating and adjusting strategies regularly

At the firm level, you can do things like:

- Setting up business account savings goals for unanticipated expenses

- Creating a detailed strategy for succession planning options

- Diversifying firm investments

Your savings and investment strategies help you when you hit an unexpected slow period or go through an illness or injury. They also help you stay on target for your intended retirement age.

In addition to saving funds, planning ahead for taxes can increase your bottom line and enhance your overall financial planning.

Tax Planning and Optimization

Effective tax planning is vital for lawyers and law firms that want to minimize liabilities and maximize savings.

There are many ways you can learn more about tax implications for the legal profession. The best thing to do, though, is to hire an expert financial professional. They can advise you about federal and state impacts on your tax planning and help you develop tax strategies that work for you and your firm.

Every dollar saved improves your law firm’s profitability. It’s worth hiring an outside expert to help you with:

- Utilizing tax deductions at the firm and individual level

- Exploring tax-advantaged retirement accounts

- Looking at other tax-saving strategies

By minimizing your taxes, you have more dollars to reinvest in the firm. This can help you grow your business more quickly. But another essential way of getting a handle on your financial picture is to reduce your debt load.

Debt Management and Repayment

Managing and repaying debt, particularly student loans, is a critical component of financial planning for lawyers. The average law school graduate carries around $165,000 in student loan debt. You may also have personal debt or professional debt that you took on to open your firm.

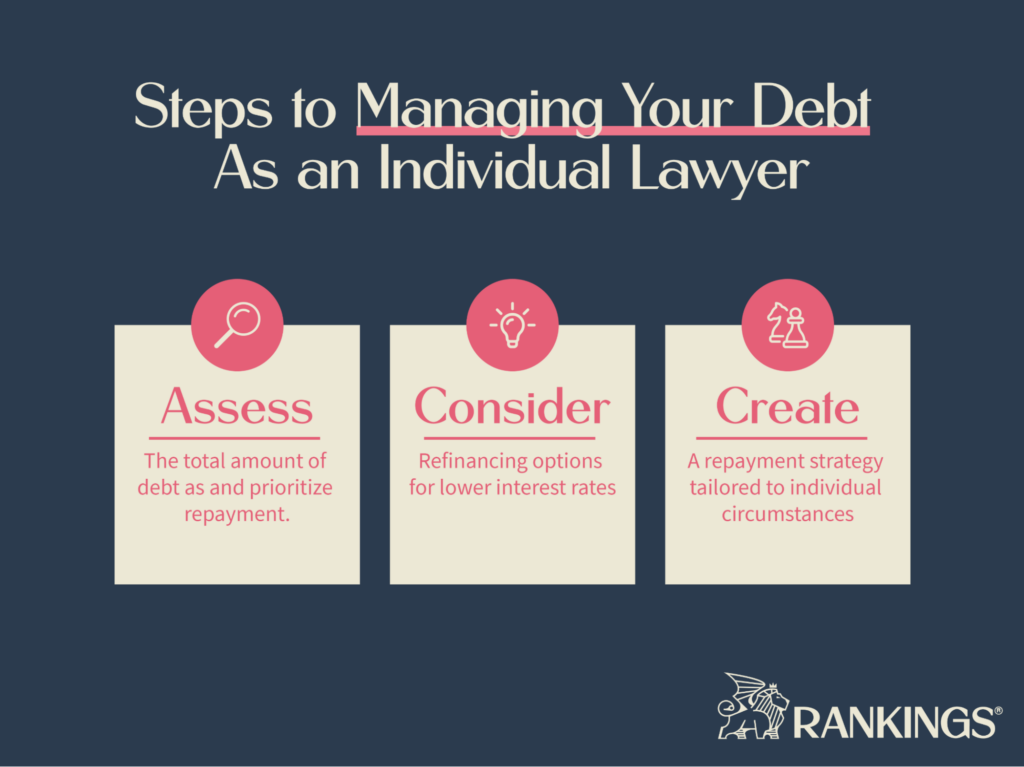

The first steps towards managing your debt as an individual lawyer are to:

- Assess the total amount of debt and prioritize repayment

- Consider refinancing options for lower interest rates

- Create a repayment strategy tailored to individual circumstances

At the firm level, continue to look at revenue, savings, and debt together. Reducing debt is a top goal for many law firms. This is especially true if your firm took out credit cards, loans, or working capital to get through a difficult time or to expand into a new area.

When you create and commit to a plan, there’s a much higher chance you’ll follow through. While debt management and repayment is only one part of your financial plan, it’s an important one.

It can seem overwhelming to address all these aspects by yourself. That’s why plenty of lawyers choose to seek the financial advice and services of experienced professionals to help with many aspects of financial planning.

Collaborating with Financial Professionals

You may not be aware of every strategy and tool out there to help you with your finances. Further, the world of finance changes and adapts over time—sometimes drastically.

That’s why it’s best to work with a financial planner who can help you see what you need right now as well as what you may need in the future.

Experienced financial advisors can provide valuable insights and guidance for lawyers and law firms in their financial planning journey.

Having someone in your corner positions you to weather storms, adapt to changes in your situation, and stay on track with your big financial goals.

Put Your Best Foot Forward with Your Finances

Financial planning is essential for both individual lawyers and their law firms. It’s a critical part of achieving financial stability and long-term success. Once you’ve created a financial plan, you may feel more confident about your firm’s future.

Implementing proper budgeting, investment strategies, and tax planning can improve your firm’s financial well-being.

Marketing and client acquisition is a big part of this long-term stability. Investing in activities that bring in new clients grows your law firm and sets you on a path to profitability. Setting aside a part of your budget from growth tactics like law firm marketing can help put your business on firm financial footing.

The post Financial Planning for Lawyers and Law Firms appeared first on Rankings.